Climate-related transition risk intelligence for everyone.

Shifting to an economy that emits less carbon will likely demand widespread changes in policies, legal frameworks, technology, and market strategies to deal with both preventing and adjusting to the impacts of climate change.

Depending on how these changes happen—how quickly they occur, what they specifically target, and their overall character—there could be a range of financial risks for companies and investors.

The energy transition is leading to stranded assets, declining value and profitability for many companies. It is also creating new revenue opportunities and increasing value for businesses.

Assessing your company’s transition opportunities and risks prepares it to comply with IFRS (International Financial Reporting Standards) on Sustainability (S1) and Climate (S2), the European CSRD (Corporate Sustainability Reporting Directive), and the U.S. SEC (Securities and Exchange Commission) regulations, among other national regulations.

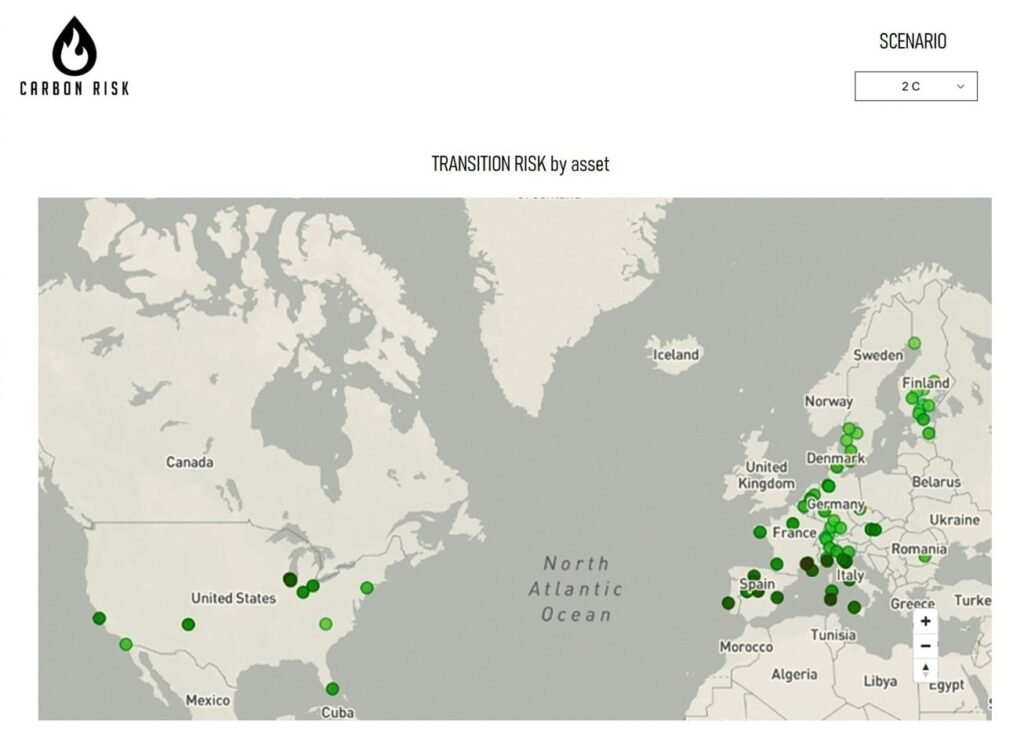

At Carbon Risk we model energy scenarios using our proprietary tools to better understand their associated climate-related transition risks on business assets.

We go beyond regulatory and policy transition risks for compliance purposes, to assess how the evolution of the market might impact on your assets under a wide range of scenarios.

On-demand assessment of transition risks

Our platform leverages state-of-the-art energy systems modelling to give you a customised analysis of your exposure to transition risks and its associated financial impacts.

Obtain immediate insight into the present and future transition scenarios that may threaten your company and business assets. Meet disclosure rules and explore scenarios to understand where your business stands today and in the future.

Contact us to generate tailored scenarios to assess your assets’ transition risks.