What We Do

We model energy futures to assess transition risks at company and asset levels for decarbonisation, disclosure, investment and divestment decision-making purposes.

Assessing regulatory and policy transition risks involve using modelling outputs from global integrated assessment models and deriving conclusions at sectoral level. Relevant national and subnational regulations should also be considered when evaluating policy risks. This can inform if the emissions and carbon intensity of a company or asset going forward are consistent with a given climate target.

In addition, market and technology transition risks must also be assessed in order to better understand the financial outlook of a company or asset. This involves capturing sectoral dynamics using asset-level models.

Moreover, consideration of uncertainty is key to fully understand the transition risks exposure of a company or asset under a wide range of scenarios.

Our energy systems modelling-based approach considers global and national policy levels to capture relevant regulations that could affect a company or asset's exposure to transition risks.

Our platform allows users to explore a wide range of scenarios to understand the resulting transition risk of their business assets. Carbon Risk provides insights into regulatory and policy transition risks, as well as market and technology ones for selected sectors.

Regulatory and policy transition risks

Is your company aligned to a decarbonisation rate consistent with the Paris agreement?

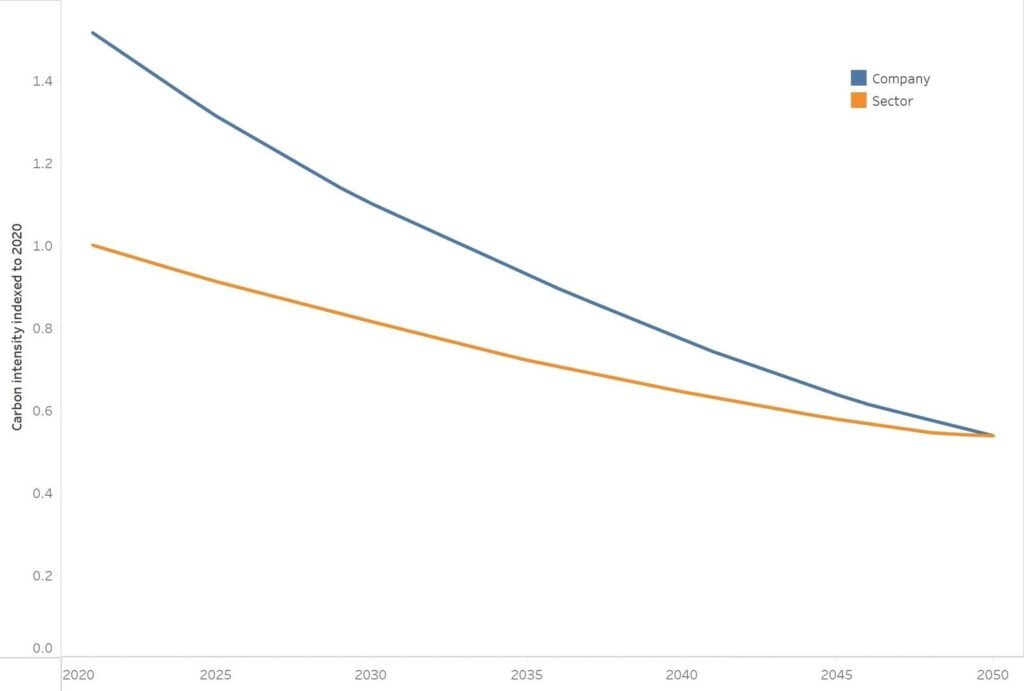

By evaluating the carbon intensity profile of a company under its current baseline we can find out how misaligned it is to a Paris-compatible sectoral pathway. This can inform the exposure level associated to regulatory or policy transition risks – and the effort level needed to align their emissions with chosen climate targets.

This transition risk assessment is helpful for disclosure and compliance purposes.

Market and technology transition risks

Are your business assets stranded or unprofitable under future sectoral scenarios?

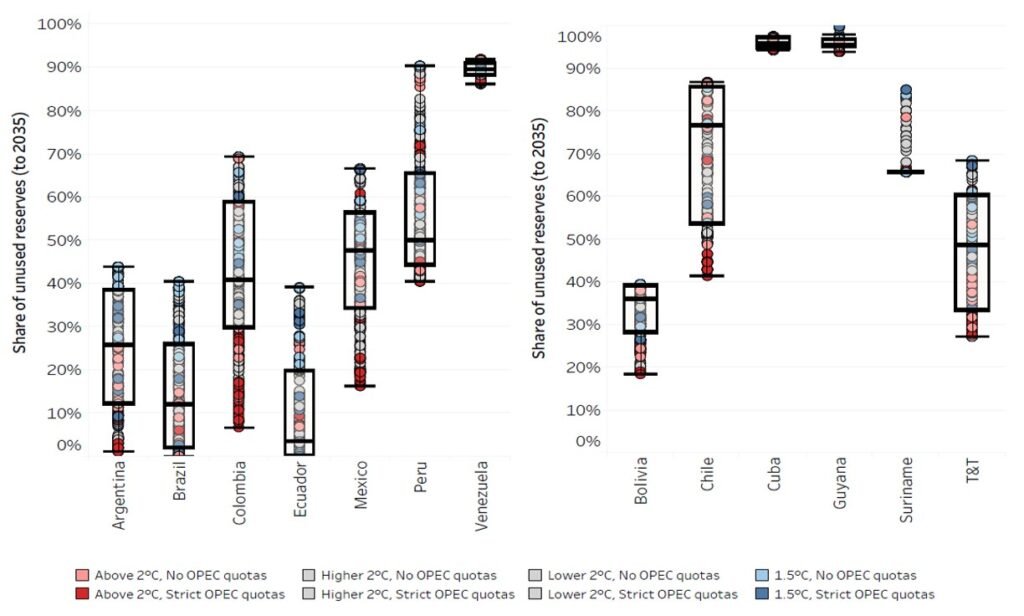

If the regulatory or policy landscape where an asset operates is more stringent than the global average, then it may be exposed to a higher transition risk. However, this is hardly informative about a company’s or asset’s competitiveness in the market under the dynamics of a low-carbon transition.

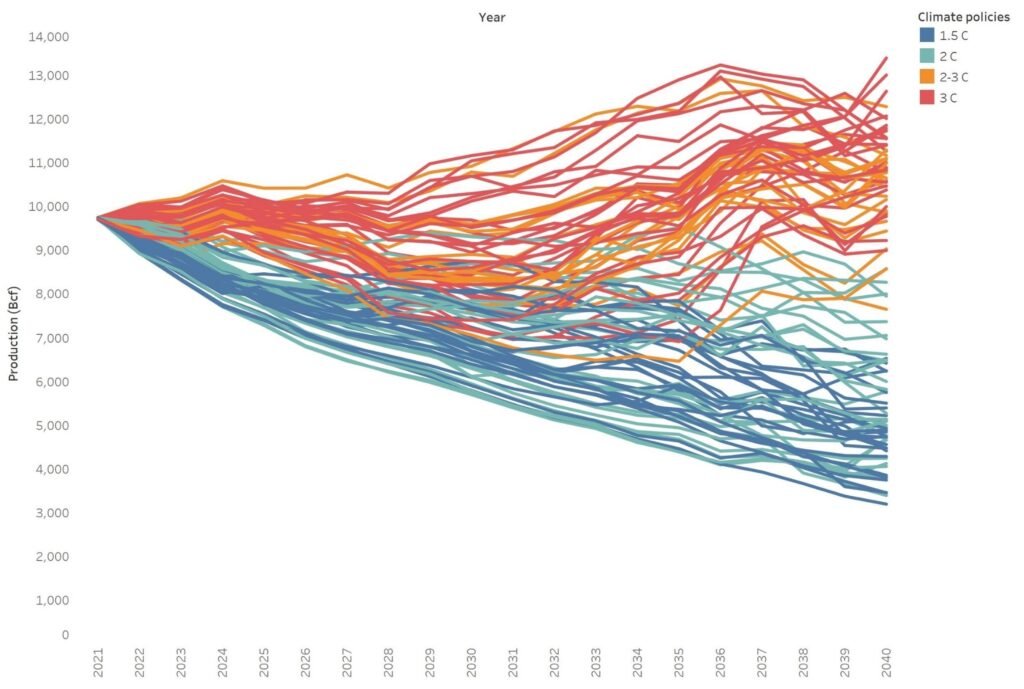

To fully assess market and technology transition risks, asset-level models that simulate sectoral dynamics are required; global energy system models alone are not enough. We use our proprietary models to explore a wide range of scenarios under various climate targets, from current policies, to scenarios consistent with 1.5ºC and net zero emissions.

Financial impact on assets and companies

By exploring the uncertainty space, we can assess how revenues may be impacted under a wide range of different scenarios.

We create a wide-range of scenarios to explore the impact of key assumptions and uncertain parameters on transition risk metrics.